puerto rico tax incentives 2021

The current tax year is 2021 and most states will release updated tax forms between January and April of 2022. Alabama Research and.

The cost of solar power has fallen over 70 percent in the last 10 years and there are still great solar rebates and incentives out there to reduce the cost even further.

. Puerto Rico enjoys fiscal autonomy which means that it can offer very attractive tax incentives not available on the mainland US with the advantages of being in a US. Local government has legislated a series of incentives to attract investment of which EB-5 Visa program participants can also take advantage. Under the Puerto Rico Energy Public Policy Act PREPA must obtain 40 of its electricity from renewable resources by 2025 60 by 2040 and 100 by 2050.

However Puerto Ricans by birth have the right to American citizenship and can move freely between the island and the US. 2022 Guide to solar incentives by state Updated. East of Aibonito and Salinas.

However the government offers a comprehensive programme of tax incentives and development subsidies to encourage investment in underdeveloped areas. Most Act 202260 decree holders seeking a Puerto Rican citizenship certificate are likely to fall into. Import taxes sales taxes.

Corporate - Tax credits and incentives Last reviewed - 31 December 2021. The 2021 Finance Bill provides that. Welcome to the State Business Incentives Database.

Wisconsin Tax Bulletin 212 February 2021. Any natural or legal person doing business in Puerto Rico who makes payments Payer for rendered services must deduct and withhold 29 from the payment made to Foreign non-resident individuals and foreign corporations and partnerships that are not registered in the Puerto Rico State Department to engage in trade or business in Puerto Rico. Darker shades represent higher numbers of incentive programs.

Puerto Rico is an island in the Caribbean Sea and has been a territory of the United States since 1898. New programs enacted since 2021. O Section 40309 relating to income attributable to domestic production activities in Puerto Rico o Section 40311 relating to empowerment zone tax incentives o Section 40414 relating to the special rule for sales or.

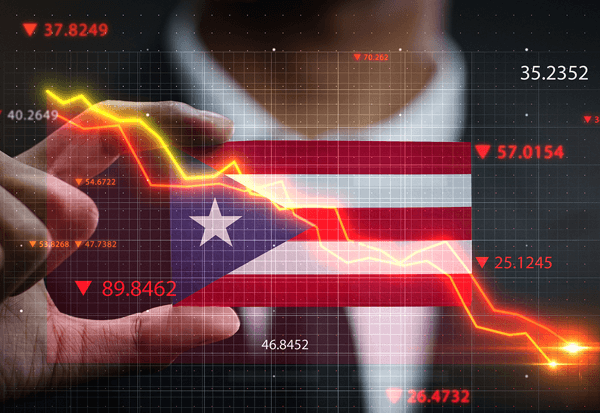

Citizenship and have resided in Puerto Rico for at least one year before applying. Taxation is highly complex due to a lack of uniformity in the local internal revenue code and a disparate amount of incentives subsidies tax exemptions tax breaks and tax deductions. For example an ordinary retail sale might have to pay.

Domestic corporations are allowed to claim a credit for any income taxes paid to a foreign country provided that the taxes are not claimed as deductions. Foreign corporations are not allowed foreign tax credits. 100 tax exemption from Puerto Rico income taxes on all short-term and long-term capital gains.

The R. And as per the facts No Puerto Rico is not a state of the USA nor a sovereign nation. Puerto rico property taxes puerto rico annual report puerto rico property tax property tax puerto rico property taxes in puerto rico property tax in puerto rico 4806a property taxes puerto rico puerto rico withholding tax puerto rico bonuses form 4806 a sales tax in puerto rico puerto rico sales tax exemption puerto rico sales.

Citizenship and at least one parent who was born in Puerto Rico. 2021 Hiring Incentives to Restore Employment HIRE. TaxFormFinder provides printable PDF copies of 775 current Federal income tax forms.

American Samoa Guam Northern Mariana Islands Puerto Rico US. Solar energy wind energy hydropower and biomass. When it comes to buying solar panels for your home weve got good news and better news.

Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico. And west of San LorenzoCayey is spread over 21 barrios plus Cayey Pueblo the downtown area and the. 92 For fiscal year 2021 July 2020June 2021 about 3 of PREPAs electricity came from renewable energy.

Officially Cayey de Muesas is a mountain town and municipality in central Puerto Rico located on the Sierra de Cayey within the Central Mountain range north of Salinas and Guayama. Incentive Programs Currently Offered in Each State by Number of Programs. Just keep in mind that to qualify for these generous incentives you must become a bona fide resident of Puerto Rico which involves spending the.

South of Cidra and Caguas. 100 tax exemption from Puerto Rico income taxes on all cryptocurrencies and other crypto assets. Have been declared a citizen of Puerto Rico by a competent court of law.

Puerto Ricos renewable resources include.

Crypto Rich Are Moving To Puerto Rico World S New Luxury Tax Haven Bloomberg

Puerto Rico Tax Act 60 Jen There Done That

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

Tax Incentives Is Relocating To Puerto Rico The Right Move For You

Save On Corporate Tax In Puerto Rico With The Act 60 Export Services Tax Incentive Relocate To Puerto Rico With Act 60 20 22

Us Tax Filing And Advantages For Americans Living In Puerto Rico

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

Puerto Rico Tax Act 60 Business Opportunities And Tax Incentives In The Caribbean

A Red Card For Puerto Rico Tax Incentives

Puerto Rico Tax Incentives Fee Increases Relocate To Puerto Rico With Act 60 20 22

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Puerto Rico Tax Incentives Can Puerto Rico Have Nice Things

Guide To Income Tax In Puerto Rico

Enjoy Lower Taxes With Puerto Rico S Act 60 Tax Incentives Relocate To Puerto Rico With Act 60 20 22

How To Prepare For A Move To Puerto Rico To Enjoy Lucrative Tax Incentives Relocate To Puerto Rico With Act 60 20 22

![]()

Taxation Puerto Rico Move To Puerto Rico And Pay No Capital Gains Tax

Centro De Periodismo Investigativo Acts 20 And 22 Created A Class Of Intermediaries Who Manage Tax Exemptions Centro De Periodismo Investigativo

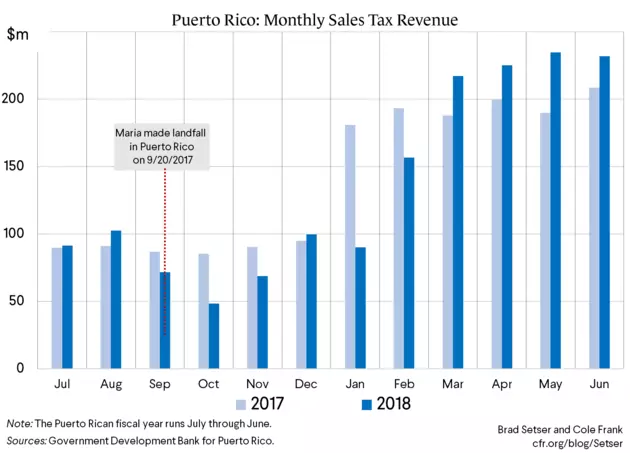

Looking Back On Fiscal 2018 As Puerto Rico Starts A New Fiscal Year Council On Foreign Relations