riverside county tax collector auction

Eastern Time on Thursday May 13 2021 and the auction will close at the time. Enter your details to get the full list of available properties for the Riverside County Tax Deed Sale PLUS our guide to tax deed investing FREE.

Riverside County Ca Property Tax Search And Records Propertyshark

Access to Assessor Treasurer-Tax Collector Auditor-Controller and Clerk of the Board.

. Riverside County Assessor-County Clerk-Recorder. Properties become subject to the County Tax Collectors power to sell because of a default in the payment of property taxes for five or more years. If you have further questions please contact our office at 951955-3900 or e-mail your questions to.

951 955-6200 Live Agents from 8 am. More than 800 tax-defaulted properties throughout Riverside County will be on the auction block open for electronic bidding beginning Thursday April 20 2020 through May 1 2020. This is the entire inventory of parcels subject to the tax collectors power of sale as of july 1 2021.

This is the entire inventory of parcels subject to the Tax Collectors Power of Sale as of July 1 2021. Riverside County Tax Collector Auction. A California documentary transfer tax will be added to and collected with the purchase price.

An auction held pursuant to the California Revenue and Taxation Code Section 3691 in which the Department of Treasurer and Tax Collector auctions and sells tax-defaulted properties in its possession. Search our database of Riverside County Property Auctions for free. The Office of the Treasurer-Tax Collector is again.

Only a successful bidder has the opportunity to purchase County assets. Ad Grab Your Best Deal On Everyday Items Unique Treasures. In Adobe Acrobat Inventory of Parcels Subject to the Power of Sale.

OFFICE OF THE TREASURER-TAX COLLECTOR RIVERSIDE COUNTY CALIFORNIA Home Search Last Search Results. Contact the Riverside County Tax Collectors Office to verify the time and location of the Riverside County tax sale. Property Tax Frequently Asked Questions.

The Riverside County Treasurer Tax-Collector will be postponing 25 parcels from this sale to Thursday July 16 2020 beginning at 800 am through July 21 2020 and closing at staggered times. Treasurer-Tax Collector 4 TERMS OF SALE TC 217 RIVERSIDE COUNTY TREASURER - TAX COLLECTOR ALL POTENTIAL BIDDERS ARE REQUIRED TO READ AND UNDERSTAND THESE TERMS I. The division also facilitates surplus bids through the use of third party auction companies.

Each of the 25 parcels will be noted as Postponed in the Auction Title. The riverside county tax collector is a state mandated function that is governed by the california revenue taxation code government code. The auction will begin at 800 am.

The amount of this tax is calculated at the rate of 055 for each 50000 or fractional part thereof. It is our hope that this directory will assist in locating the site resource or contact information you need as a taxpayer. The current 20172018 taxes which are due by December 10 2017 and April 10 2018 are included in the minimum bid.

Loading Do Not Show Again Close. Riverside california prweb january 09 2013. Complete List of Available Properties for the 2021 Riverside County CA Tax Sale.

Tell Us How Were Doing. To receive notifications on this and all Bid4Assets tax sales please sign-up for. Riverside County Sheriff-Coroner 4095 Lemon Street Riverside CA 92501 Phone.

The Tax Enforcement division is responsible for the collection of delinquent unsecured property taxes and assists Tax Sale Operations with secured property tax sales. RIVERSIDE Calif March 29 2022 GLOBE NEWSWIRE -- This April the Riverside County California Treasurer-Tax Collectors Office will host its latest online tax-defaulted property sale in. Secured - The purpose of a Secured tax sale is to return tax defaulted property back to the tax roll collect unpaid taxes and convey title to the purchaser.

Ad Search All of the Most Up-to-Date Foreclosure Listings Available Near You. Tax Collector Tax Sale Information Parcel Inventory. HUD Homes USA Can Help You Find the Right Home.

Reassessment The rate or value of a property when a change in ownership or completion of new construction occurs. Skip to Main Content. Tax Cycle Calendar and Important Dates to Remember.

Common Issues Youll Want to Avoid After Your Purchase. Also a 3500 per-parcel-won administrative fee will be added to the final sale price. Please check back soon for information on Riverside Countys next tax-defaulted properties sale on Bid4Assets.

Foreclosure properties updated daily. This roll serves as the basis for generating property tax revenues that fund our safe neighborhoods good schools and many other community-wide benefits. A Special 400 Offer from Tax Title.

The riverside county tax collector is a state mandated function that is governed by the california revenue taxation code government code and the code of civil procedures. Pacific Time 1100 am. Bids start as low as 40000.

Many assessment records of real and personal property are available for sale. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Riverside County CA at tax lien auctions or online distressed asset sales. Riverside County California Tax Sale Information.

Change of Mailing Address. Ad Thousands of Real Estate Auctions. The Riverside County Treasurer Tax-Collector will be postponing 25 parcels from this sale to Thursday July 16 2020 beginning at 800 am through July 21 2020 and closing at.

Office Hours Locations Phone. Inventory of Parcels Subject to the Power of Sale. 951 955-6200 Live Agents from 8 am - 5 pm M-F Click Here to Contact Us.

In accordance with California law the Riverside County Tax Collector will commence the public auction of properties for which the taxes interest and fees have not been paid and continues from day to day until each property is. The offices of the Assessor Treasurer-Tax Collector Auditor-Controller and Clerk of the Board have prepared this site to introduce taxpayers to the organizations that handle the property tax process in Riverside County. Office Hours Locations Phone.

Bids start as low as 150100. The Riverside County Tax Collector is a state mandated function that is governed by the California Revenue Taxation Code Government Code and the Code of Civil Procedures. Additionally the City of Riverside has enacted the Real Property Transfer Tax Ordinance and charges an additional tax of 55 per each 50000 or fraction thereof.

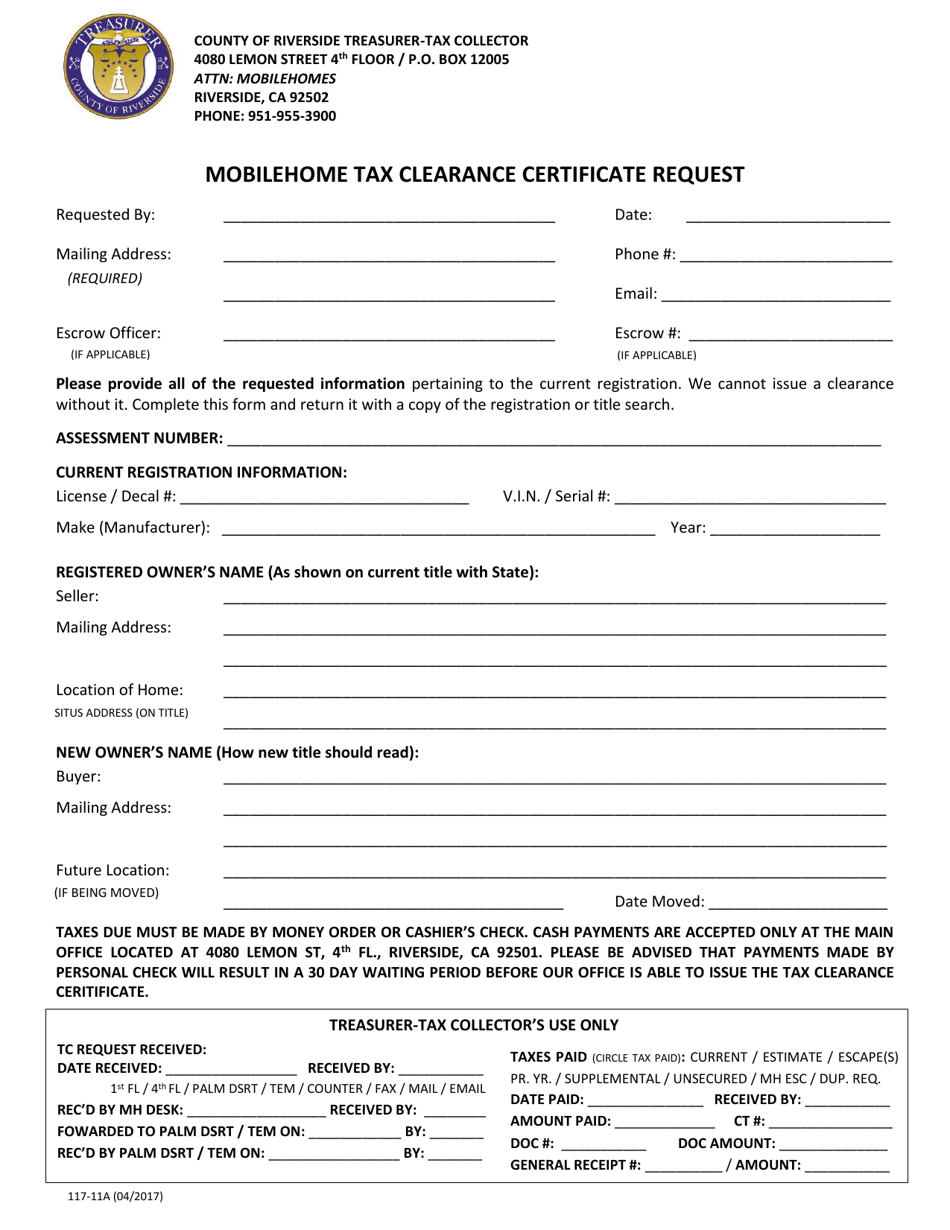

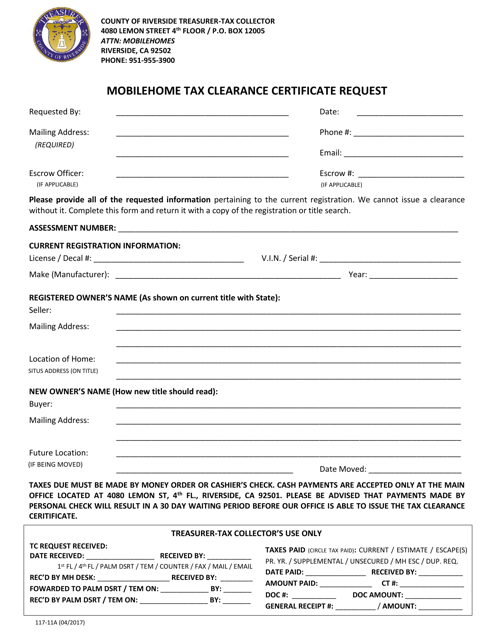

Auctions are conducted to dispose of the unclaimed property of deceased individuals. More than 800 tax-defaulted properties throughout Riverside County will be on the auction block open for electronic bidding beginning Thursday. Mobilehome Tax Clearance Certificates.

Find and bid on Residential Real Estate in Riverside County CA. Greater Palm Springs Tourism Business Improvement District GPSTBID Short Term. Free to Bid Live No Obligation.

Riverside County CA currently has 3366 tax liens available as of May 28. Riverside County Assessor-County Clerk-Recorder.

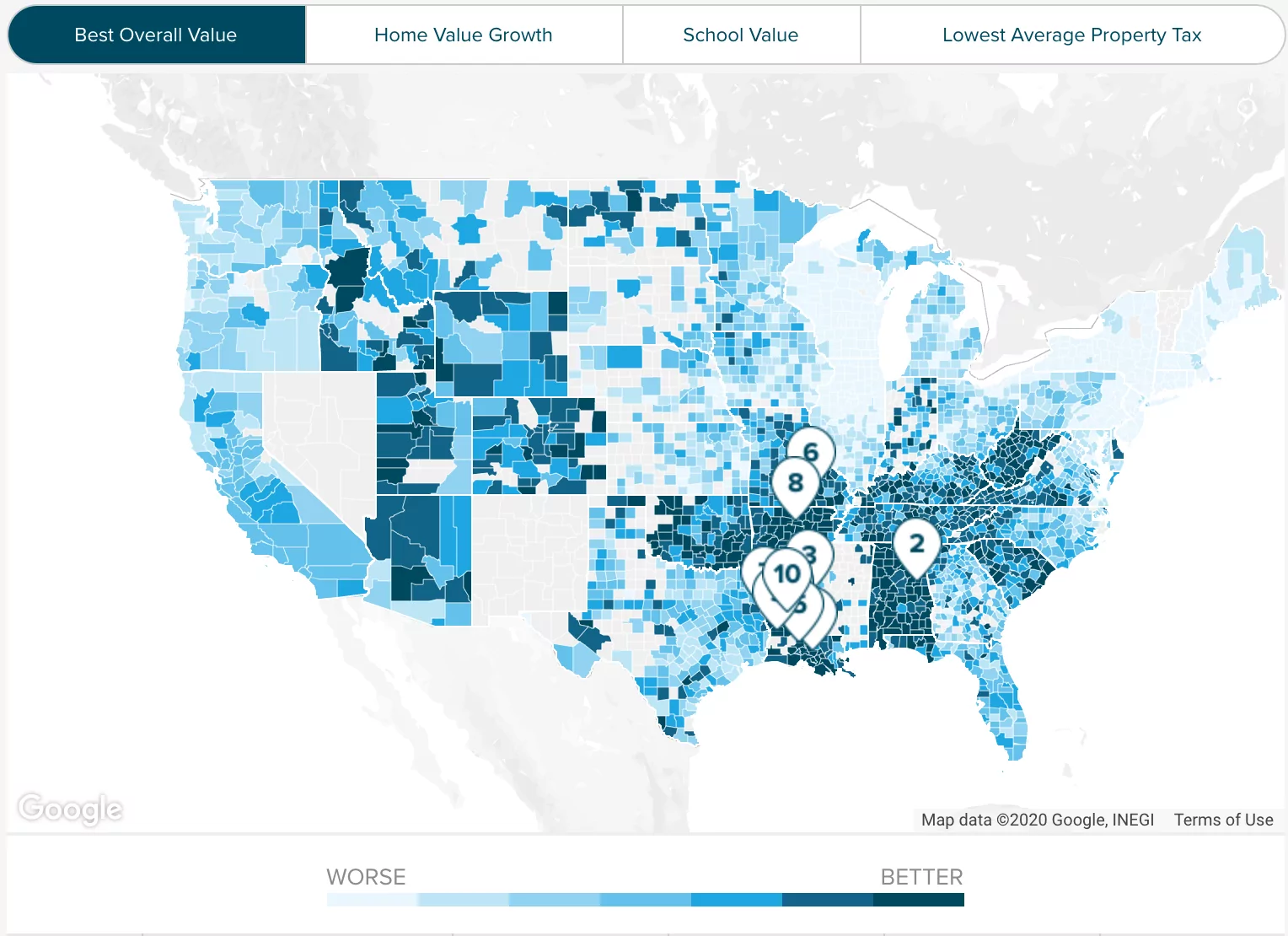

Understanding California S Property Taxes

Bid4assets Riverside County Ca Tax Defaulted Properties Auction

Riverside County Tax Collector And Assessor Riverside Property Tax

Programs And Services Environmental Health County Of Riverside

Riverside County Ca Property Tax Search And Records Propertyshark

Riverside County Ca Property Tax Search And Records Propertyshark

Riverside Ca Land For Sale Real Estate Realtor Com

Bid4assets To Auction Over 590 Tax Defaulted Properties For

Meet Your Treasurer Tax Collector

Riverside County Ca Property Tax Calculator Smartasset

Riverside County Ca Property Tax Calculator Smartasset

Form 117 11a Download Fillable Pdf Or Fill Online Mobilehome Tax Clearance Certificate Request Riverside County California Templateroller

Form 117 11a Download Fillable Pdf Or Fill Online Mobilehome Tax Clearance Certificate Request Riverside County California Templateroller

Residential Property Registration For Abandoned And Distressed Properties Faqs

Riverside County Tax Collector And Assessor Riverside Property Tax